The first images that come to mind when people hear the word “disaster” are often pictures of Mother Nature wreaking havoc. But disaster can arrive in different ways. Chemical spills, fires, hackers, tech failures, and network infiltrations can all cause major disruptions in business, too.

Now we also have viral pandemics. The global coronavirus crisis has shown us that disaster can come in forms we’d never imagined. Perhaps most importantly, it has shown us that, when planning for disasters, we have to consider events that were previously not on our radars. The last pandemic approaching similar proportions happened in the early 20th century, and the way businesses operate has changed a lot since then. As a result, the COVID-19 pandemic has proven to be uncharted territory for most.

Even if we can’t foresee every possible disruption, though, we can still plan proactively and try to ensure that our businesses are protected. Self-reliance and preparation can go a long way toward safeguarding operations; they can help your business continue operating and providing reliable customer service until things return to normal. Here are some steps you can take:

1. Conduct a risk-assessment and business-impact analysis

Disasters can’t always be averted (or as COVID-19 has shown, predicted), but you can mitigate their effects if you’re armed with knowledge and a plan. Understanding your risks can help you decide what to do to avoid the devastating effects associated with all disasters.

- List every possible vulnerability your business faces and define each as an internal or external risk, so you know what you might be up against. (Keep in mind that external risks are harder to control.)

- Rank these vulnerabilities according to how likely each is to occur. For example, businesses in the southeastern U.S. would rank hurricanes higher on the list, while California businesses would rank earthquakes and wildfires higher.

- Outline which of your assets are at risk and analyze the potential business impact for each area affected.

Once you better understand your business’ risks and impacts, you can create comprehensive business-continuity and disaster-recovery plans. Once you have a plan in place, remember to test it every year to see if it still works. Keep in mind that technology, staffing, and other variables will change over time, variables that significantly affect any plan.

2. Check your business insurance

As part of devising a response plan, once you’ve assessed your risks and understood the potential impacts of disaster, be sure you know what your business insurance policies do and don’t cover. Then you can take steps to fill in any gaps.

While you’re at it, why not take a look at your personal policies, as well? Do your home, auto, and life insurance policies still meet your needs? Perhaps newer options like a home warranty could fill in any gaps your homeowners’ or renters’ insurance doesn’t cover.

Also, double-check to see that you have all your necessary documents in order, so they’ll be ready if a disaster occurs. Putting your personal life in order can clear your mind to focus on your business needs without worry.

3. Examine your company’s financial standing

It’s always dangerous to operate on a shoestring, but the risks of not having enough money increase tenfold in an emergency. Scrutinize your company’s assets, debts, and revenues. Do you have enough financial resources to keep your company afloat during and after a disaster? If not, take steps to ensure a more stable financial future.

Having a financial cushion is helpful in the event of unexpected expenses associated with disaster. In times like this, knowing you have a healthy credit standing not only offers you potential access to funding but also provides you with the peace of mind that you’ll have options if your bank account runs out.

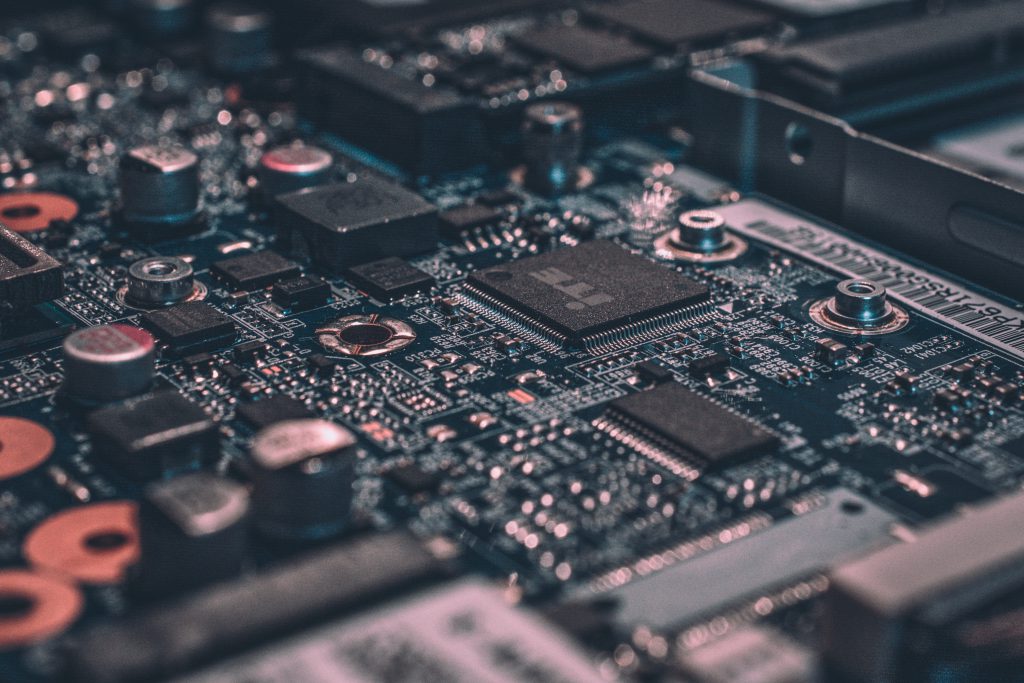

4. Back up your data and IT resources

Ideally, tech contingencies will have been heavily fleshed out in your business continuity plan, but IT deserves a mention of its own. Your database is one of your biggest assets — and one that’s hardest to replace if stolen, lost, or corrupted. Be sure to back up your data often, and bolster your systems’ virus and security protections regularly. Take every precaution to be sure that you’re up to date and you won’t lose any information essential to your business.

Especially if you rely on e-commerce, you can’t operate if your website goes down. What about future and pending sales, returns, and other data in the processing stage? You can’t afford to lose access to these, so be sure to have a backup plan for your operating software as well — many businesses of all sizes find cloud solutions to be ideal.

Being prepared helps safeguard against disaster

Until something terrible happens, we often don’t realize how unprepared we are. Most businesses didn’t have COVID-19 on their radars. Sadly, early projections suggest more than 100,000 small businesses have permanently closed since the pandemic arrived.

While every eventuality can’t be predicted or mitigated, strong planning certainly can increase the chances for a business’ survival. If you haven’t established business continuity and disaster recovery plans, don’t delay. In the long run, they’ll help your company survive. Not only that, but they’ll also help preserve jobs and allow you to continue offering solid customer service, ensuring that you can keep your loyal consumer base even during and after hard times.