Millennials and Gen Z are rewriting the rules of personal finance, seeking financial freedom, and embracing alternative financial solutions that align with their values and preferences. Tech-savvy and research-driven, they have unique expectations and preferences when it comes to financial services, and traditional financial institutions must adapt to stay relevant.

While attracting younger generations is critical across verticals, the financial services industry places a high value on younger consumers who (hopefully!) may become loyal lifelong customers. So, what can they do to attract their target audiences? Unsurprisingly, we turn to the data.

Winning with millennials and Gen Z

In May 2023, Sogolytics conducted a census-based study of 1000+ consumers in the US with the intention of understanding their banking preferences. In a recent webinar, our team showcased selected findings. During this highly informative 50-minute webinar session, the presenters and participants explored the following key areas:

- What it takes to win with Gen Z, millennials, and other generations

- How consumers prefer to get info and to interact with primary financial institutions

- How to keep track of the evolving expectations of your target audience

- How to add fintech advantages while staying true to your organizational and community values

Here is a glimpse of a few key insights and strategies shared during the webinar for financial institutions to attract and retain millennials and Gen Z customers.

Consumers’ banking priorities

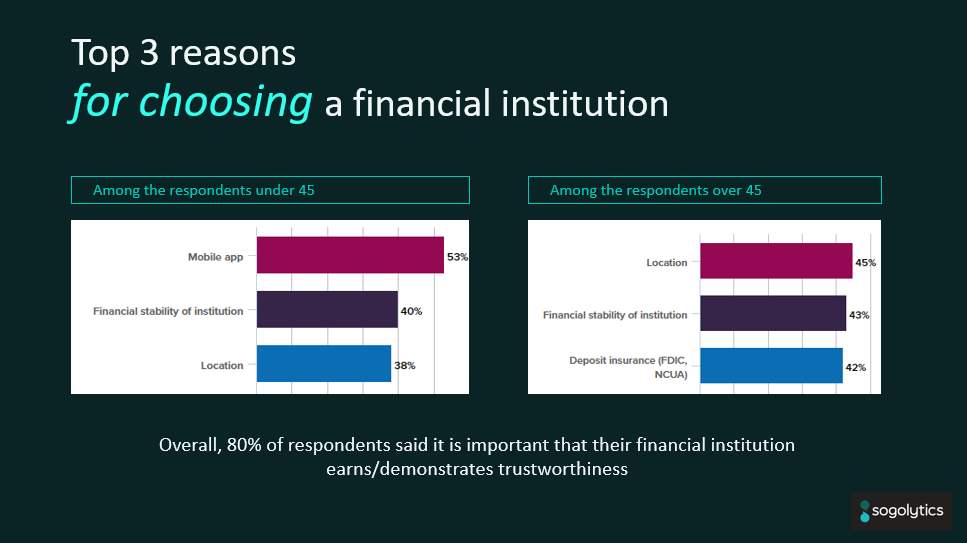

While many articles on how to choose a financial institution lead with suggestions that consumers should consider the institution’s values and carefully evaluate the various fees charged, our research offers a different suggestion. Instead, results show that that the most important factors for consumers under the age of 45 are mobile banking, followed by financial stability of the institution, and then its location. For consumers older than 45, location is the most common factor to consider while the other two criteria in the top 3 are the financial stability of the institution and deposit insurance.

Using social media to connect with customers

As an old marketing saying goes, ‘Be Where Your Customers Are’ and Gen Z and millennials are active on social media, mobile apps, and online forums. How effectively are banks and financial institutions using these platforms to engage with customers, answer questions, and provide support?

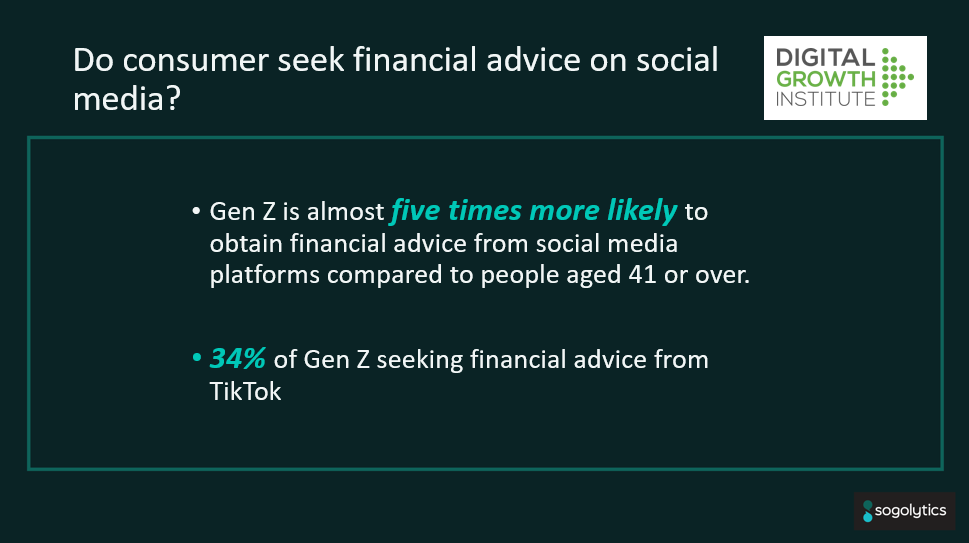

The social media results are especially striking for Gen Z consumers, who are five times more likely than older consumers (41+) to obtain financial advice from social channels. Plus, in an era where some are concerned about the security of third-party apps, 34% of Gen Z consumers seek financial advice from TikTok. Are you prepared to deliver a truly ominichannel experience?

Proactive strategies covered

If you’ve been asking any of these questions recently, this session can help! Do any of these challenges sound familiar?

- How to keep track of the evolving expectations of your target audience

- How to attract and retain Gen Z and millennial customers while earning their loyalty

- How to leverage market research data and make CX automation work for you

- How to win ‘Cool Kids’ with social listening and gather actionable data

- How to tell your brand story in a way that connects with younger generations

- How to truly personalize customer experience

- How to showcase your organization community involvement

Discover how financial institutions can deliver a seamless digital experience and foster customer engagement through personalized interactions and build lasting relationships with millennials and Gen Z customers. Watch the full webinar now to gain valuable insights.

Interested in understanding the preferences of your own unique consumers? Book a personal consultation today and start collecting your own data and statistics to inform your marketing strategies.