When we talk about Nursing Homes and Assisted Living Facilities, we are talking about long-term care provided to a specific category of people in the United States, namely: those who don’t warrant hospitalization but, due to ill-health, cannot live unassisted. The latter covers the elderly in most cases, but also younger adults who are physically or mentally impaired.

To provide a seamless resident experience, nursing homes and assisted living facilities must demonstrate certification by Medicare or Medicaid or both (the latter in growing numbers). In 2019, with around 15,000 nursing homes across the country, approximately sixty-six percent were for-profit facilities. In the same year, there were 1,680,000 nursing home beds accessible nationwide.

Why a focused look at Florida?

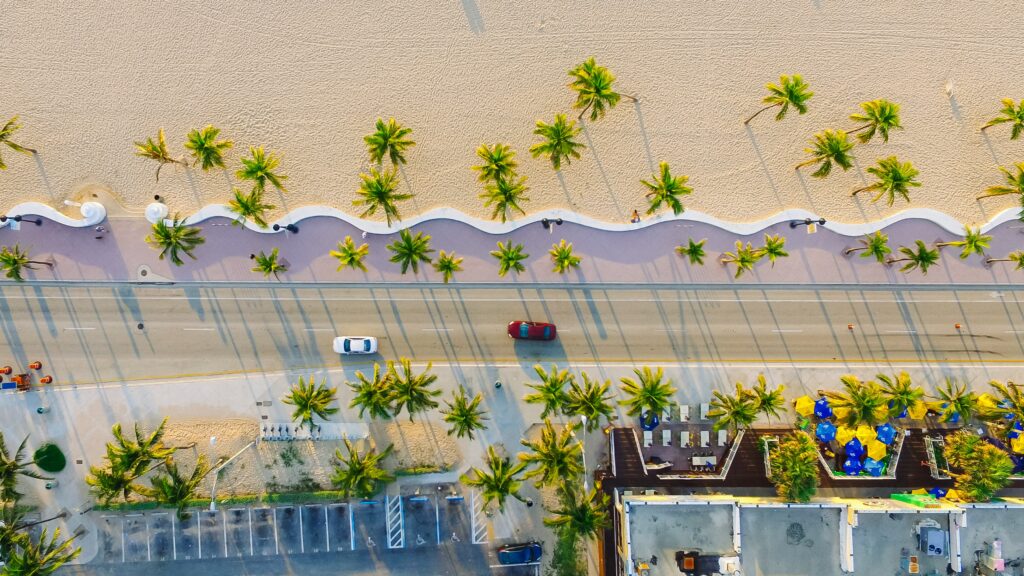

Everyone knows that people go to retire in Florida. Although a flood of younger families looking for the sun and space since the pandemic has joined them, older age groups represent a significant state demographic. So whenever the latter enters the picture, healthcare is close on its heels. Aging requires close monitoring of illnesses and frailties hitting from all directions trying their best to derail our active lifestyles.

Nursing homes, as we’ll show below, are an institutional driver that keeps the retired population on an even keel when things get rough. Without them spearheading healthcare initiatives in every corner of Florida – from Miami to Jacksonville to Tallahassee – resident experience and living a quality life would be a severe challenge.

With a growing population projected, tying healthcare into Medicare and Medicaid is essential. Thus, nursing homes undoubtedly become a fundamental part of the resident experience discussion.

So what’s the inside scoop about Florida’s elderly long-term care?

When one looks at the hard facts, nursing home care emerges as one of the state’s economic drivers. Seventy-one thousand nursing home residents (at an average 85% occupancy rate) occupy approximately 85,000 beds at any time in 691 licensed entities. In other words, Florida represents over 5% of the aggregate beds throughout the US, in 4.5% of the country’s certified facilities.

And that’s not even half the story. Assisted living facilities provide another 106,103 beds in 3,080 accommodations – a mind-boggling number. The financial metrics are even more eye-popping:

- Did you know that it takes just over $100,000 annually to cover the cost of an nursing home private room? A semi-private one is not much less – a little over $89,000.

- Assisted living facilities are much more affordable to the general population at $48,000 for a private room.

- Without Medicaid, thousands of souls would flounder. It covers:

- Sixty percent of resident long-term care expenses.

- Almost all primary low-income individuals’ healthcare and resident experience needs – the latter being the most significant portion of Medicaid support.

- On average, patients staying in nursing home and assisted living facility facilities for longer than a year (specifically, 386 days).

- Medicare carries the shorter end of the resident experience stick (rehabilitation services), amounting to 19% of the long-term care burden. Rehabilitative care, by its nature, takes just over one month on average.

Crucial trends in the nursing home and assisted living facility arena

Despite all the above numbers, Florida’s nursing home occupancy per over-65 capita is the lowest in the country. And that’s quite something when you consider the old age demographic accounts for 20% of the states’ population, expected to grow to 25% eight years from now. Moreover, according to Eldercare.com and the Kaiser Family Foundation Report, the trends point to Florida leading the way for everyone else. For example:

- The state’s nurse staffing rates rank way above every other mainstream state (i.e., ten). If you throw in smaller population regions, it holds 9th position.

- The average resident experience in Florida nursing homes benefits from 44% more daily direct-care hours than the national average (i.e., 3.6 hours per resident per day vs. 2.5 hours on average).

- Overall quality care, judged on awards and national rankings, took Florida from tenth in the nation eight years ago to seventh in 2018.

So, are older people enjoying a better lifestyle/resident experience thanks to the nursing home and assisted living facility infrastructure gaining state traction? The trends speak for themselves. For example, antipsychotic drug use fell by ten percent in the seven years between 2011 and 2017, according to the federal Centers for Medicare and Medicaid Services (CMS). It may not seem much, but consider that it dropped in the face of a growing old person population and nursing home development. Moreover, the decline represented arguably the largest in the nation.

Aside from medications, nursing homes and assisted living facilities have participated in impressive improvements in disease and illness treatments. The ones that stood out as showing excellent resident experience progress were:

- Infections (which are a constant threat with Covid strains still in the air).

- Falls – a continuous threat as one grows older and frailer.

- Pressure ulcers from any number of causes.

- Wandering away from home as a result of dementia setting in.

- Need for physical restraints.

The economic role of Long-Term Care nursing homes and assisted living facilities in Florida

Florida’s economy depends on these healthcare facilities to the tune of $27 billion employing therapists, caregivers, nurses, interns, and vendor employees in numerous industries. It boils down to nearly 300,000 jobs that divide into direct, indirect, and induced categories. In addition, federal and state yearly tax revenue tops out at $3.6 billion, indicating that the state’s prosperity depends on more than just tourism and hospitality services. The most compelling resident experience benefits rest in the domino effect nursing home and assisted living facility expansion has on the market, with each job inside the facilities creating two more in adjacent businesses.

The nursing home business has gained momentum by hanging on to the coattails of trends in its favor. There’s no getting away from the Big Data that tells us:

- 250,000 join the nursing home and assisted living facility ranks every year

- The 85 and older age group will grow by 300% in the next twenty-eight years.

Everything points to the resources available to nursing homes, and assisted living must expand dramatically to accommodate the growth.

How corporate is the nursing home business in Florida?

It’s a highly organized, enterprise-centric operation in Florida and most states. It must be to meet the strict certification requirements and regulations. Also, juggling the multiple resident experience challenges simultaneously without dropping the ball takes substantial training, monitoring, and reporting to government bodies. Without deep pockets to fund the nursing home and assisted living facility growth, the industry would totter and fall.

Consulate Health Care is Florida’s largest nursing home provider and a typical example of a big-time entity in the long-term care system. It represents the growing trend toward corporate involvement with a network of related for-profit businesses, away from “mom-and-pop” competitors.

Privately owned (by equity firm Formation Capital) and based in an Orlando business park, Consulate is the sixth-largest nursing home provider in the US. It has a complex subsidiary structure of real estate holdings, management services, and rehabilitation specialties connected to seventy-seven company-owned nursing homes. Indeed, Consulate controls more than 10% of Florida nursing homes in 32 counties and every city and central town.

In 2015 (the latest accessible state records), Medicare paid Consulate $224.5, and Medicare contributed $206.62 daily for each eligible patient. Seven years later, in 2022, the numbers are undoubtedly considerably higher.

Learning from Florida’s nursing homes

Florida is the poster child of long-term care through nursing homes and ALFs, demonstrating a robust program to meet an aging population’s needs. The danger with unfettered growth is that it can lead to significant resident abuse and counterproductive strategies that do more harm than good. However, the entities driving the industry appreciate the true meaning of resident experience, keeping it buoyant and thriving despite new and complicated challenges. It’s not to say there aren’t gaps in the system.

Still, the industry is sophisticated and ready to find solutions in a state that understands what’s at stake for its population. Sogolytics understands these concerns and is driven to help improve staff and patient experience with our advanced healthcare experience management platform.