Customer loyalty is crucial for any business, but in banking, it’s particularly critical. With so many competitive pressures from traditional financial institutions, fintech, and evolving customer demand, it’s more important than ever for banks and credit unions to better understand their customers – and how to win their loyalty.

In a recent webinar, Sogolytics explored how to nurture and retain loyal customers in the financial services sector. Here are some of the highlights of the webinar.

What is NPS – and why does it matter?

The most prevalent metric for understanding customer loyalty is the Net Promoter Score, or NPS. It’s the basic yardstick used to measure customer loyalty.

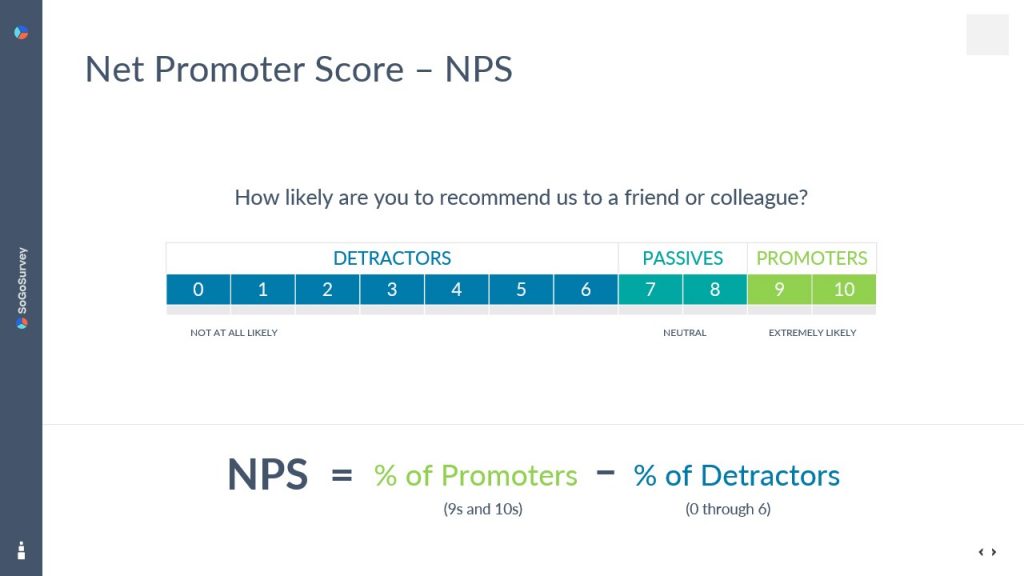

Measuring NPS usually begins with asking a simple question on surveys, measured on a scale of 0 through 10: How likely are you to recommend us to a friend or colleague?

Those answering 0 through 6 on the scale are Detractors, those answering 7 or 8 are Passives, and those answering 9 or 10 are Promoters. The NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

Most companies use Net Promoter Score as a quick and simple way to measure how their customer experience (CX) programs are performing. The objective, then, is to turn the Detractors into Promoters.

Why focus on detractors?

Simple: They’re the most vocal of your customers. They’re the most likely to leave your financial institution and can do the most damage to your brand through word of mouth. In fact, customers will mention a good brand experience to 9 people but will tell 16 people about a bad one.

The best way to counter this action is to focus your efforts on areas that will more quickly pay off. That is, triage your customer support efforts to stop the damage done by Detractors.

This means addressing and answering the following questions:

- How quickly can you address a problem?

- What happens when a problem cannot be resolved? Or when it takes an unusually long time to resolve?

- How many customers have an unresolved issue? What’s the average resolution time?

- What will frustrate customers?

And further, if negative reviews about your institution are appearing:

- How do you discover negative reviews about your business?

- Do you have a plan in place to address them?

- What’s your online reputation? Is it going up or down?

Part of this triage effort also involves identifying the “edge issues:” Which areas of your customer service are driving your customers away? And on the other end of the spectrum, which areas are impressing them the most?

Beyond NPS

Of course, there are other metrics at play as well. Monitoring things like customer satisfaction (CSAT) or customer effort (CES) will give you a more complete picture of what’s going on. NPS is a great snapshot, but analyzing and understanding these other metrics will give you a better understanding of why you’re developing Detractors in the first place.

Act on feedback

Simply collecting data isn’t enough. The next logical step is to analyze the feedback, determine what areas are driving the negative experiences, and take decisive action to fix these issues. A comprehensive customer experience platform with advanced analytics can help here.

Part of this strategy also involves:

- Addressing global issues: Keep an eye on the fundamentals of the business

- Going for quick wins: Rack up some early success to keep the momentum going

If you’d like to see how Sogolytics’s five-step methodology can help your financial institution move Detractors to Promoters in six months, reach out to our team for a free demonstration.

Be sure to visit our webinar page to view this and many other presentations at your convenience.